LPO Loans

Fund your local purchase orders with us

You don’t have to miss out on orders, contracts and projects because of inadequate financing. Let us provide you with the cash you require to finance purchase orders.

No collateral required

We don't require collateral to give loans to businesses. In fact, we don't think collateral makes a lot of sense for MSMEs.

Zero paperwork required

Set up your business profile and apply for loans from the comfort of your home, office or wherever you are.

Decision within 1 business day.

We understand how important speed is to making the most of opportunities. You'll get a response from us within 24 hours of applying.

No guarantors required

Our tech-enabled loan approval system ensures that only the minimum requirements are asked of you.

Loans up to 200M

Big or small, we finance projects and business initiatives of all sizes. Let us know how much you need. We can handle it.

How to apply

Follow these 3 steps to get your purchase orders funded.

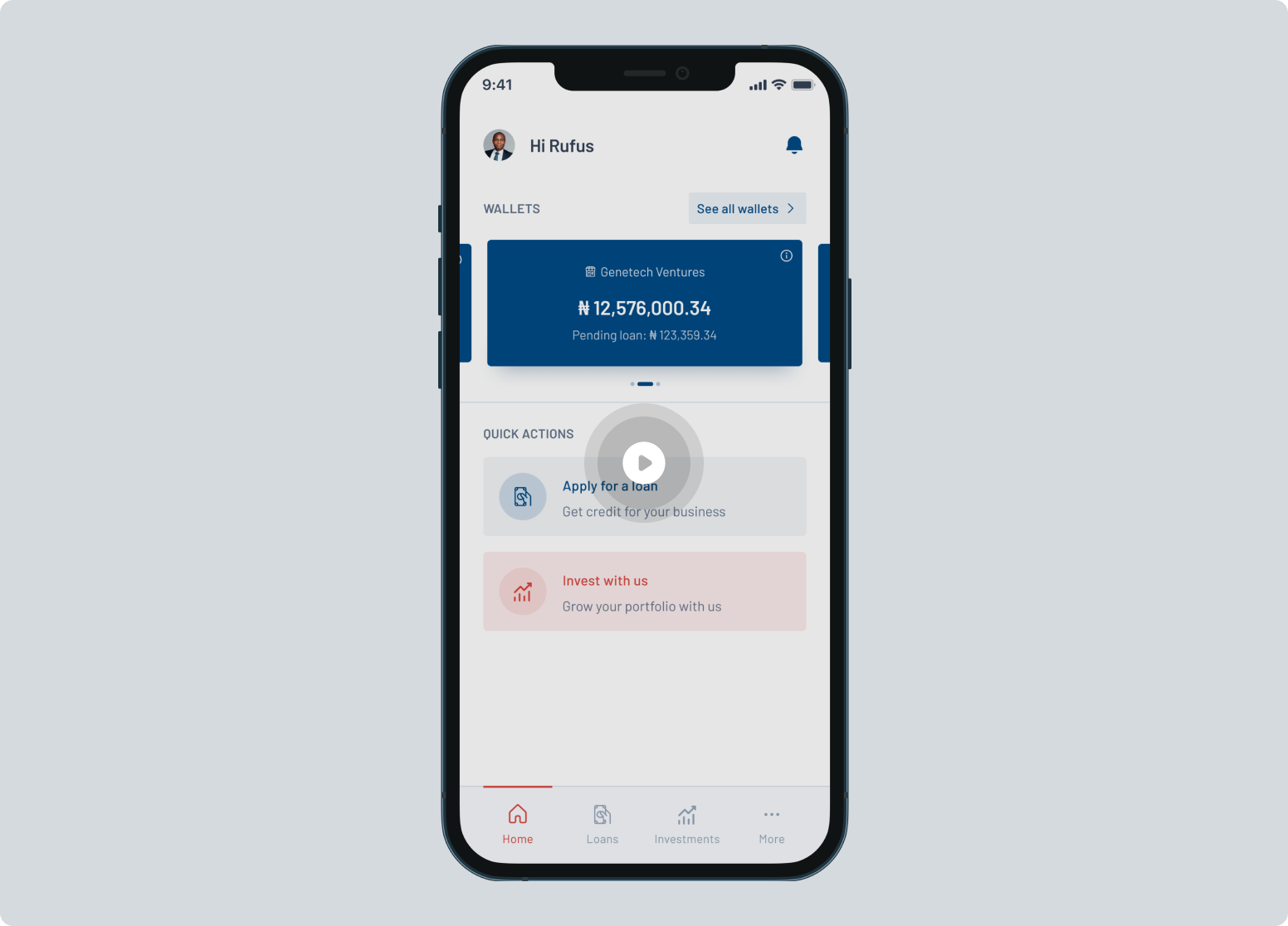

Step 1

Create and set up an account

Create an account through our web platform or Android/iOS mobile applications and follow the prompts to set up your account.

Step 2

Tell us about your business(es)

Set up your business profile by giving us a few details about your business. We’ve made it possible to set up multiple businesses so you don’t have to create multiple accounts on our platform.

Step 3

Apply for a loan

Once your business profile is all set up, you can instantly apply for a loan on our platform. Our team will reach out to you within a few hours of your application.

Frequently asked questions

Everything you need to know about Working capital loans

Our interest rates are calculated based on multiple factors which include your company's credit history, the loan amount and the tenor of the loan. Apply for a loan today, and get an offer within 2 bbusiness days.

Get funding now

Create an account now to get started on funding your purchase orders.