For vendors

Increase outputs and profit with our solutions

Vendorcredit offers you a seamless way to increase reliability and stability of your supply chain while reducing risk by offering our products and services to suppliers and vendors in your network.

Products

Leverage growth opportunities

Vendorcredit offers you a seamless way to increase reliability and stability of your supply chain while reducing risk by offering our products and services to suppliers and vendors in your network.

Purchase Order Finance

We finance purchase orders for projects and contracts awarded to your company for you so you don’t have to worry about the contract costs.

Learn more

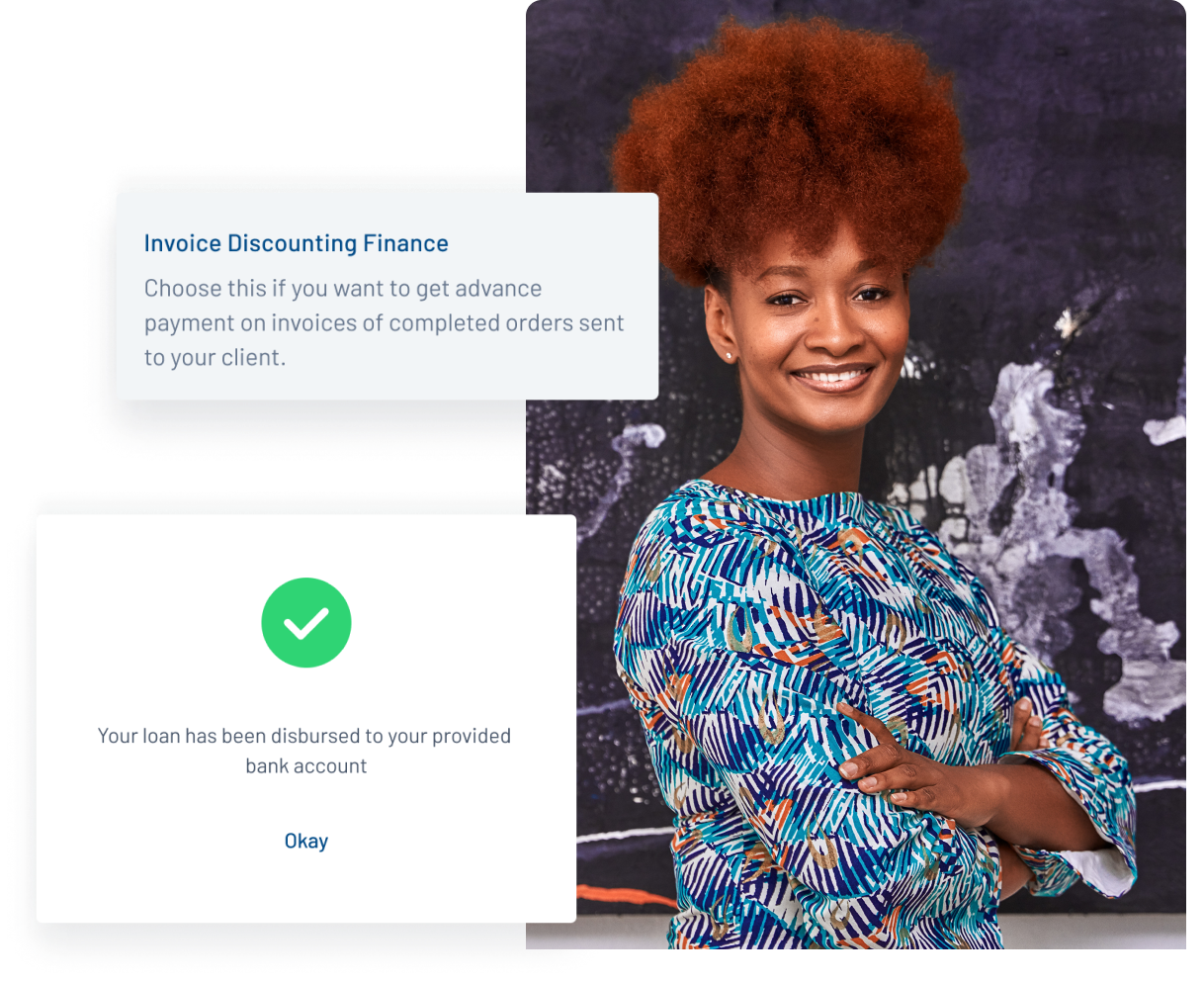

Invoice Discounting

We can offer you advance payment on your unpaid invoices so you can redirect the cash to solve other pressing business needs or execute new orders and contracts.

Learn more

Asset Finance

We’ll finance the purchase of assets your business needs for speedy growth. You don’t have to wait months to raise the funds before increasing the efficacy of your business output.

Learn moreWorking Capital

We offer working capital finance that helps to keep the lights running in your business. You can stock up fast and never have to disappoint customers again.

Learn more

Our solutions have helped our customers serve clients like these

WHY VENDORCREDIT?

Why should you choose Vendorcredit?

We understand the needs of businesses that service supply chains and we've tailored our products to suit just them!

No collateral required

We don't require collateral to give loans to businesses. In fact, we don't think collateral makes a lot of sense for MSMEs.

Zero paperwork required

Set up your business profile and apply for loans from the comfort of your home, office or wherever you are.

Decision within 1 business day.

We understand how important speed is to making the most of opportunities. You'll get a response from us within 24 hours of applying.

No guarantors required

Our tech-enabled loan approval system ensures that only the minimum requirements are asked of you.

Loans up to 200M

Big or small, we finance projects and business initiatives of all sizes. Let us know how much you need. We can handle it.

Low interest rates

We offer interest rates as low as 2% per month. You don't have to worry about exorbitant interest rates and charges.

Get funding now

Create an account now to get started on funding your purchase orders.

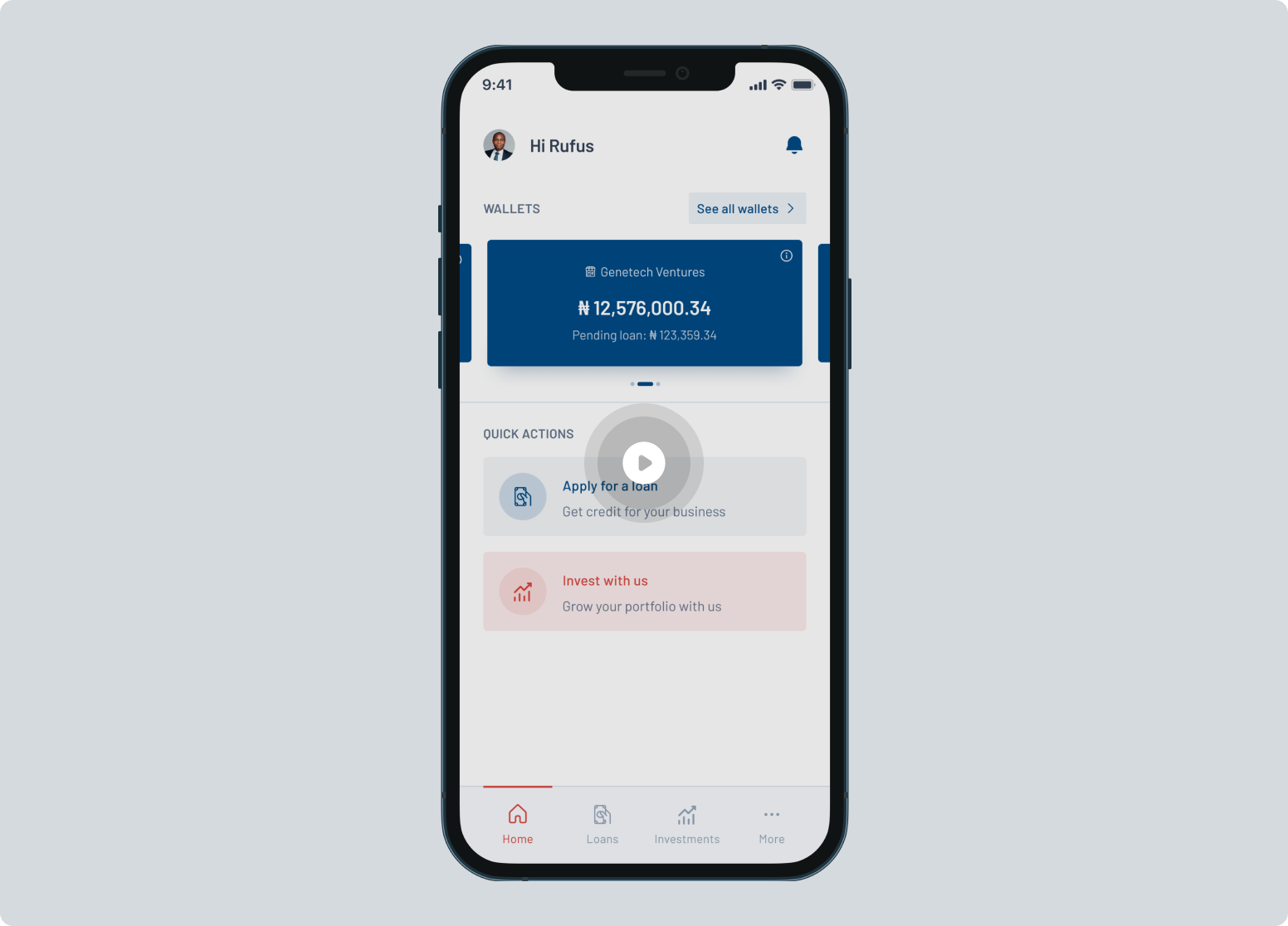

Step 1

Create and set up an account

Create an account through our web platform or Android/iOS mobile applications and follow the prompts to set up your account.

Step 2

Tell us about your business(es)

Set up your business profile by giving us a few details about your business. We’ve made it possible to set up multiple businesses so you don’t have to create multiple accounts on our platform.

Step 3

Apply for a loan

Once your business profile is all set up, you can instantly apply for a loan on our platform. Our team will reach out to you within a few hours of your application.

Get funding now

Create an account now to get started on funding your purchase orders.